Many politicians, especially those on the right, preach the gospel of Trickle-Down Economics. The theory is that if businesses have more money they will employ more people and therefore it is essential to reduce business taxes. Raising the income of the wealthiest in our society, they say, will make everyone better off.

Many politicians, especially those on the right, preach the gospel of Trickle-Down Economics. The theory is that if businesses have more money they will employ more people and therefore it is essential to reduce business taxes. Raising the income of the wealthiest in our society, they say, will make everyone better off.

The trouble is there is a basic flaw in the logic of the theory: it assumes employers employ more people because they have spare money. This is not correct. Employers employ more people because they need them, and the only reason a business needs more workers is if it cannot keep up with the demand for their products or services within their existing staffing level.

Ever since the 2012 election season started, the GOP has been insisting President Obama is destroying the economy and the only way to save it is to reduce taxes, especially on business. This rhetoric has only increased in the current election season. There are at least four major pieces of evidence that prove that this is not true though:

1. After the initial increase in unemployment caused by the Global Financial Crisis in 2008, which was in turn caused by weak financial sector regulations in the US, the unemployment rate has decreased ever since. There have been steady improvements in labour statistics is whichever metric is used: the unemployment rate issued by the US Bureau of Labor Statistics, or Gallup’s calculations of the underemployment rate, the real unemployment rate, the good jobs rate, or the labour force participation rate.

1. After the initial increase in unemployment caused by the Global Financial Crisis in 2008, which was in turn caused by weak financial sector regulations in the US, the unemployment rate has decreased ever since. There have been steady improvements in labour statistics is whichever metric is used: the unemployment rate issued by the US Bureau of Labor Statistics, or Gallup’s calculations of the underemployment rate, the real unemployment rate, the good jobs rate, or the labour force participation rate.

2. After an initial decrease following the GFC, all the stock market indicies have been steadily increasing and are at their highest levels ever. Whether you choose the Dow Jones, the NASDAQ, or the S&P 500, the market is consistently improving.

2. After an initial decrease following the GFC, all the stock market indicies have been steadily increasing and are at their highest levels ever. Whether you choose the Dow Jones, the NASDAQ, or the S&P 500, the market is consistently improving.

3. The value of the US dollar has been increasing as its economy has been doing better on average than most of the rest of the world. In order of value, the US’s top five trading partners are Canada, the European Union, China, Mexico, and Japan. The dollar has increased in value against all those currencies.

4. On its own, GDP growth appears to be small in recent years. However, when compared to other members of the OECD, the United States has had very good growth. It is suffering not because of internal issues, but because of ongoing problems in the global economy, especially three of its biggest trading partners – the EU, China, and Japan.

The truth is that currently a majority of US businesses actually have plenty of money. In the second quarter of 2015, FactSet advised that S&P 500 companies (excluding financial companies) collectively had US$1.43 trillion in cash reserves on their balance sheets. As CNN Money pointed out, “Corporate America has more cash than the economies of Belgium and Sweden combined.” That is apparently the second highest it had been in the previous ten years, and the highest was just two quarters earlier – the last quarter of 2015.

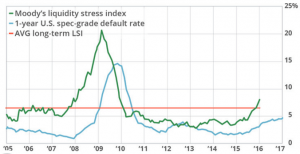

And they have no reason to worry about spending it either. Moody’s Liquidity Stress Index for the US and Canada (for companies rated B3 or higher) shows that 97.4% currently have enough liquidity to cover their cash needs for the next year. This is up from 96.6% from the previous survey, conducted in 2011. MarketWatch reports that 70% of the companies that are in trouble are oil and gas companies due to the low international prices for those commodities.

These companies are not using the trillions they already have to employ more people and there is no reason to expect that giving them even more would change things. There’s a good reason for that too – as pointed out above, they don’t need any more employees.

The current problem in the world economy is lack of demand, not lack of money. People simply aren’t spending. If manufacturers, for example, employed some more people all that would happen is they would create a big stockpile of whatever product they make. It is more than likely that would lead them to lose money – potential extra costs would include the cost of storage and having to sell the product at a reduced price to get rid of it.

When the economy stalls like this, the government can make a difference, but it must intervene at the point that is causing the problem. As I said, currently that is lack of demand, not (as tax-cut advocates would have everyone believe) lack of money. Only an increase in demand will lead to the conditions that will cause businesses to increase employment.

So how does a government make people spend money?

1. Increase social security payments. This always provides an immediate increase in demand as most recipients of social security payments live week to week and struggle to live within their income. Therefore any extra money is spent immediately, increasing demand. This in turn causes employers to employ more people to match the demand. As this works through the economy, people come off social security and into paid work. That in turn reduces the overall cost of those payments and increases average incomes.

2. Increase the minimum wage. I wrote about this at length here. Basically, it works the same as increasing social security payments.

3. Decreasing taxes on low- and middle-income earners. This provides an increase in income and works in the same way as the two options above.

4. Increase spending on infrastructure, both new and maintaining the old. This option would be a particularly good one for the United States at the moment. In fact, I would go so far as to say it would be irresponsible for the government not to do this. There has been insufficient spending on infrastructure for years, and interest rates are at record lows. The longer maintenance is deferred, the more it costs, and it would be far better to borrow money now at low cost than for the next generation to have to do it when the cost of both the finance and the repairs are much higher. Further, the US’s failure to invest in infrastructure is getting to the stage where it’s damaging its potential. The US currently has only one port capable of servicing the new supertankers (Louisiana) for example.

Unless it has cash reserves (which the US government doesn’t), governments need to borrow to finance whatever option/s it chooses. However, this is exactly the same as a business borrowing money for a new machine that will make it more money in the future – the government is borrowing money to invest in the building blocks of its economy to increase the income for both itself (tax revenue) and its people.

Governments do need to be careful when utilizing any of these options because they can lead to excessive inflation and a large debt burden. However, at the moment other governments are willing to lend money to the United States at extraordinarily low interest rates because they see the country as a safe bet, making borrowing an attractive option.

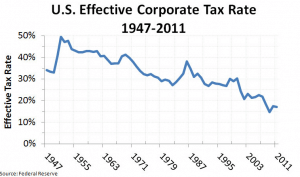

There are economic conditions for which the “cut business taxes” solution is the correct one, and those conditions have existed recently enough for many to remember them. When business taxes, interest rates, and unemployment are high, it works. Business taxes and interest rates are at record lows though, and unemployment is at a moderate level. Despite the rhetoric of the GOP, there is no historic correlation between cutting business taxes and reducing unemployment or increasing economic growth.

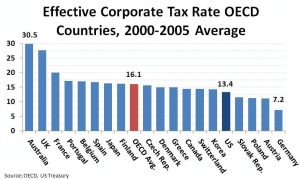

In 1954 the top marginal rate for personal taxes in the US was 91%, and by 1975 that was still 70%. Business taxes have been decreasing for decades and as can be seen by the graph above, have always been lower than personal taxes. In addition, the percentage that businesses have contributed to the overall tax rate has continued to decrease. Also, despite constant complaints that business tax rates in the US are the highest in the world, that actually isn’t true. The effective corporate tax rate in the US, which is corporate taxes/corporate surplus, is well below the OECD average.

The corporate tax rate is not too high – it is not high enough. Reducing it will not create employment. It will make the current economic problem worse because it will take money out of the economy and put it into the hands of a few businesses who don’t need it. The current economic situation will be made worse by the policies of all those candidates who propose reducing taxes on business.

If you enjoyed reading this, please consider donating a dollar or two to help keep the site going. Thank you.

Nice, Heather. And of course pretty obvious really. It’s crazy that some think jobs can be increased without increasing demand. Of course, the goal of those who argue for trickle-down economics is not to create jobs, but to create more wealth for the 1%, and they’ve been fantastically successful, not just via the tax cuts but by the increasing financialisation of the economy which leads to a form of economic activity that produces nothing tangible.

If Obama had taken your advice even more to heart, the recovery would have been even better. He gave trillions to banks to encourage them to lend, when again, the problem was that no one wanted to borrow. I’ve heard it argued that it would literally have been better to dump the money out of air planes over cities so that those in desperate need could then inject it directly in to the economy.

A good economist to read about the myths that underpin our current neo-classical economic system is Steve Keen, who is one of the few to have predicted the GFC and did so in 2001 when the economy seemed invincible. The book is called Debunking Economics and while it is highly technical in parts, the commentary is understandable by lay people. Highly recommended.

Thanks Ken. That’s all economics is really – common sense. In fact I remember one of my textbooks called it “The Science of Common Sense.” I’ll look out for Keen. I want to read more about income inequality too. That wasn’t such a big deal when I went to uni so it didn’t get talked about much except in relation to socialism and communism. Nowadays it’s recognized as being really important in capitalist economies too and there’s lots of good stuff being written about it.

Keen refers to modern economics as a religion and when you read him, you realise he’s not exaggerating at all, so lacking in evidence and even basic logic is economic theory. Did you know mainstream economics models don’t include the concept of debt? No wonder they didn’t see the GFC coming.

And yes, lots of research is being done on inequality now. There’s the article on the OECD study I linked to in another post which had NZ at the top of the list of countries that lost economic growth due to inequality. The book Inequality: A New Zealand Crisis, edited by Max Rashbrooke goes into more depth. And of course there’s The Spirit Level: Why More Equal Societies Almost Always Do Better, by Wilkinson and Pickett in the UK, which shows that everyone, even the rich, do worse in more unequal societies than in more equal ones.

Thanks Ken. My instinct is that everyone does worse in less equal societies, and I’d like to see the modelling. At the same time, I think we’d get the best result if capitalist societies were made more equal rather than imposing communist-type models.

I’m surprised at the OECD study – most of theirs (and many others) have NZ doing pretty well. I’m certainly not denying that we have work to do though.

Sure, but fortunately very few seriously advise communism as a means of addressing inequality these days. That is not only unnecessary, but historically ineffective.

Yes, thank goodness. And it’s frustrating that so many in the US see socialism and communism as the same thing too. Any decent person wants a certain level of socialism in their country – it’s how much that should be the argument. It’s true that if it’s done wrong it can mess up a country’s economy and the fix is then often worse than the disease (I’m thinking of Thatcherism).

All these calls for a flat tax from the US right worry me a lot. So much of the Republican base thinks they’re a good idea. If/when they don’t get implemented those people will continue to be extremely disaffected and that’s dangerous. It’s one of the main reasons I think bad as Trump is, Cruz would be worse.

And the US government as a whole needs to make a long-term effort to get their IRS viewed differently. I remember when everyone hated the IRD here. People were committing suicide because of the way they were treated – it was a disgrace. It’s taken a long time, but things are much better now. Of course, it helps that our tax code has been simplified so much by successive governments. The US one is completely screwed.

Nice to see some rich people who understand that they benefit from “socialism” too.

http://www.commondreams.org/news/2016/03/21/new-yorks-millionaires-governor-cuomo-raise-our-taxes-please

The trust fund babies Ken admires sure have odd timing, considering that New Yorkers just got handed an object lesson in the supposed decency of socialism. The immediate past leaders of both houses of the legislature, one from each political party, currently await incarceration following convictions less than three months ago, within two weeks of each other, on separate corruption charges. (You have to wonder how much more decency New Yorkers can take!)

This is not a coincidence. Graft increases in direct proportion to opportunities for graft. Opportunities for graft increase in direct proportion to resources under political control. If economics is just common sense, common sense suffices to tell you that putting resources in the hands of politicians, bureaucrats and social engineers — beyond the minimum necessary to preserve law and order — is the most unproductive thing you can imagine.

As one who sees the State of New York help itself to a super-sized slice of my own hard-earned bread, let me assure you that these jokers already have at their disposal more than ample resources to pave every street and highway in the known universe twice a week, and inspect every milk cow on the planet twice an hour.

If these letter-writing fat cats are so desperate to give even more to the cause of good old-fashioned graft, nobody’s stopping them. They can simply write out checks to the treasury in any amounts that flatter their inflated egos, and kindly shut up already.

Socialism is well and good inside a monastery or commune. But there is nothing decent about coerced socialism. It is at best irrational and at worst monstrous.

Corruption is most common where the legal system is weak and government is unfair, not necessarily where it dominates. While it’s true that there was major corruption in places like the Soviet countries, that has not improved since the fall of communism. (I am not, of course, defending communism.) If you look around the world, it is countries that have the greatest inequality that have the most corruption – it is rife throughout Africa for example. That is because in many places government has insufficient control.

New Zealand regularly tops the list of countries perceived as being least corrupt in the world. We also have, by world standards, a reasonably fair society. (That’s not to say we couldn’t make quite a few improvements, because we could.) There are two big differences between NZ and the US:

1. Everyone has access to free, quality healthcare. No-one has to worry that an illness or injury will see them living on the streets.

2. Schools are funded in such a way that those in the most need get the most money. We don’t have the disgusting US system where schools are funded by property taxes so poor areas get crap schools and wealthy ones get the best. A decent education is available to all. Also, all our universities are good ones, and although students have to borrow to attend if they don’t have the money, the loan rates are low and available to anyone.

The US is already a socialist country – that’s what Medicare, Medicaid, and Social Security are: socialism. Like most people in the US, you have been indoctrinated to believe that the only form of socialism is that practiced in the Soviet Union, Cuba, or Venezuela. Providing a free education to your children is socialism, and it is good for the country. It is good for business to have a larger pool of educated workers to choose from. More educated people are less likely to commit crime, so it saves money long-term. Whenever a new road is proposed by the government, part of the cost-benefit analysis is how that will benefit business, because it obviously does to some extent and that can be measured.

Even a little thing like cochlear implants and other hearing interventions. The evidence is that a majority of those in prison are functionally illiterate and oftentimes the reason for that is that they simply couldn’t hear the teacher properly. If hearing difficulties are picked up early and treated, the whole future of that child can be changed and long-term it saves the country money re police/justice etc and that person becomes a contributing member of society instead. That is socialism.

There is a limit to how much a government can do, and it has to make choices. The argument is not whether or not to have socialism, the argument is how much. When it’s done right, socialism improves the lives of everyone in society.

And a government, chose by the people, are the best ones to decide what the priorities should be. They must collect data though, and their decisions should be made based on data and evidence, not because they’ve been swayed by a lobbyist. If government has proper processes in place to decide what the priorities are then in theory corruption doesn’t get a look in because too many people have to be bribed to make a decision go the wrong way.

I’m not sure it’s helpful to accuse others of having been indoctrinated. Millions of Americans know about socialism not because they’ve been indoctrinated, but because they, or their grandparents or someone they love, fled here to escape some form of socialist tyranny somewhere in the world. Indeed, everybody comes to America to get away from an oppressive ruling class of one description or another. So I have to say your seeming faith in a technocratic elite is not something many Americans would relate to.

Libertarians and many others actually would agree with you that we should just go ahead and label any unnecessary public spending as socialism, starting with the post office. Far be it from me to argue otherwise. So, yes, the USA already is burdened by some misguided socialistic schemes that we desperately need to modernize and privatize.

Whatever you call it, political meddling in the economy helps nobody but the politically connected. The only way to achieve higher living standards for everybody in the long run is for investors to risk their own resources to invent smarter, faster, cheaper ways to meet people’s needs.

What people in the US (and New Zealand) ran from was communism, not socialism. There is a difference. Most of northern Europe has socialist governments and are quite successful. The countries that are dragging Europe down are those in southern Europe. And just because I’m in the mood to throw a fly in the ointment, they’re also the most religious ones.

The World Bank compares effective business tax burdens across 189 economies. Not surprisingly, the USA’s excessively high taxes put us at a serious disadvantage when competing for investment with other advanced economies.

For example, Canada has significantly reduced business taxes (from about 47.5% in 2004 to the current 21.1%) and now ranks 9th lowest out of 189 economies. By contrast the USA has seen no federal corporate tax reform in 30 years and now ranks 53rd from the lowest with a 43.9% effective business tax. (This is for domestic firms. It’s even worse for multinational firms, since the USA is the only G7 country without a territorial tax system.)

In considering effective business tax burdens, it’s not meaningful to compare averages across industries and countries, for two reasons: One, tax rules regarding depreciation and other deductions vary by country and impact different industries very differently; and two, a real-world investment decision is made with respect to one or more specific locations, not based on an average. Accordingly, the World Bank study runs the numbers country by country using a detailed hypothetical test case. In this process, it considers all relevant business taxes at all levels of government, as well as the actual compliance costs associated with paying these taxes.

Here are selected rankings, from lowest tax burden to highest:

Hong Kong – 4th

Singapore – 5th

Ireland – 6th

Canada – 9th

Denmark – 12th

Norway – 14th

United Kingdom – 15th

Finland – 17th

Switzerland – 19th

South Africa – 20th

New Zealand – 22nd

Bahamas – 24th

Korea – 29th

Australia – 42nd

USA – 53rd

http://www.doingbusiness.org/reports/thematic-reports/paying-taxes

That analysis is not about how much tax is paid, but how easy or hard it is to pay taxes. As everyone knows, the US tax system is screwed up, and it’s no wonder it comes in 53rd.

However, there are other factors besides taxes that businesses take into account when they start a business. The World Bank also analyses several factors in its Ease of Doing Business rankings: http://www.doingbusiness.org/rankings

Despite coming in 53rd in the ease of paying taxes, which us taken into account, the US comes in 7th overall.

1st Singapore

2nd New Zealand

3rd Denmark

4th South Korea

5th Hong Kong

6th UK

7th US

8th Sweden

9th Norway

10th Finland

13th Australia

14th Canada

15th Germany

17th Ireland

25th Poland

It’s not as bad in the US as you make out.

No, actually, as I explained, the rankings I cite from Table A3.1 reflect total tax costs — including compliance costs in addition to the tax itself, but not compliance cost alone. Yes, the tax code is in serious need of reform — that’s the point. Yes, we have a better business climate overall compared with many places, but this discussion was/is about taxes. And they’re too high any way you slice it.